The residential energy storage market is undergoing a transformation this year.

According to a new report from GTM Research, U.S. Residential Battery Storage Playbook 2017, this year will be the first ever in which grid-tied residential battery storage system deployments outnumber new off-grid and grid-independent systems across the United States.

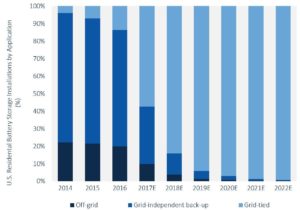

While data has been difficult to come by due to the nature of the deployments, off-grid and grid-independent backup storage applications have dominated the U.S. residential energy storage market to date. GTM Research estimates that in 2016, over 4,400 residential battery systems were deployed across the U.S., representing 127 megawatt-hours of storage. Of those systems, 86 percent were off-grid or grid-independent backup.

This year, however, we’ll see a major reversal of the trend, says GTM Research. By the end of 2017, grid-connected deployments will make up 57 percent of annual deployments. By 2022, that figure will balloon to 99 percent, as annual off-grid and grid-independent backup deployments will remain relatively flat.

Both homeowners and utilities are driving the revolution, each with a different set of needs. Homeowners are adding storage systems for backup power or for monetary savings, while utilities encourage adoption in order to mitigate the effects of high solar penetration on the grid. Also driving or hindering growth are local regulations, policies and incentives.

“It is most instructive to think of the residential battery market not as a monolithic entity, but rather as a patchwork quilt of geography- and homeowner-specific applications that will be stitched together over time,” write the authors of the report. “Each application lends itself to a specific set of system requirements, which may potentially overlap with the requirements for other applications. Further complicating the matter, homeowner preferences and site-specific constraints may alter or limit what can be achieved by a given system.”

Today, residential energy storage is concentrated in a few markets with the right mix application and regulatory environment, notably Hawaii, California, and states in the Northeast. However, GTM Research expects a confluence of factors, including falling systems costs and utility rate design, to drive growth for the segment.

“The underlying drivers of product-market fit, and hence industry growth, point toward a robust future outlook for residential battery storage,” write the authors. “The market has the potential to dramatically evolve over time, and industry stakeholders can drive that evolution through technology, product and regulatory efforts.”

Recent Comments